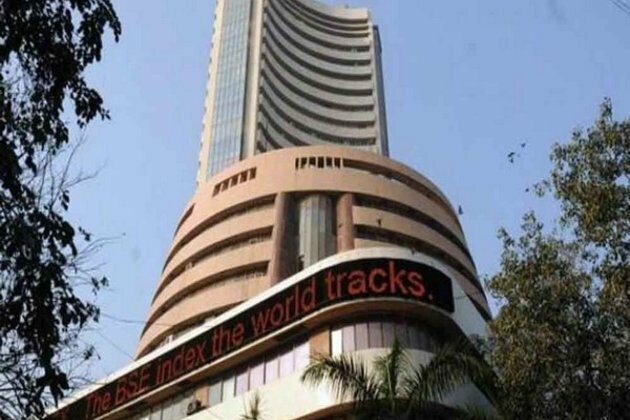

Sensex slides 735 points amid weak global cues; banking stocks tumble

ANI

23 Sep 2022, 13:33 GMT+10

Mumbai (Maharashtra) [India], September 23 (ANI): Extending the losses to the fourth consecutive day, the Indian stock market's key indices, Sensex and Nifty, slumped by more than one per cent on Friday amid weak global cues after the US Federal Reserve signalled an aggressive increase in interest rate to control inflation.

The 30 stock SP BSE Sensex was trading 713.7 points or 1.21 per cent down at 58,406.02 points at 12.32 pm against its previous day's close at 59,119.72 points.

Earlier, the Sensex started the day in the red at 59,005.18 points and slumped to a low of 58,345.91points in the intra-day.

This is the fourth consecutive day of losses in the markets. The Sensex had dipped by 337.06 points or 0.57 per cent on Thursday.

The broader Nifty 50 of the National Stock Exchange was trading 220.40 points or 1.25 per cent down at 17,409.40 points against its previous day's close at 17,629.80 points.

The Nifty had lost 88.55 points or 0.5 per cent on Thursday.

The stock markets have slumped across the world after the US Federal Reserve on 21 September announced 75 basis points increase in policy interest rate.

Banking stocks witnessed heavy selling pressure. HDFC Bank slumped 2.87 per cent to Rs 1443.05. The scrip had lost 2.18 per cent on Thursday. All major banks including Axis Bank, IndusInd Bank, State Bank of India, Kotak Bank and ICICI Bank were trading with huge losses.

Power Grid Corporation crashed 5.36 per cent to Rs 208.25. The index heavyweight Reliance Industries Limited was trading 1.55 per cent down at Rs 2447.30.

Only five out of the 30 scrips that are part of the benchmark Sensex were trading in the positive. Sun Pharma jumped 1.95 per cent to Rs 924.60. ITC jumped 0.99 per cent to Rs 348.50.

The share price of Tata Steel rallied while subsidiaries slumped by upto 9 per cent on Friday after the company's board approved the amalgamation of seven group companies.

On the BSE, Tata Steel share was trading at 1.30 per cent higher at Rs 105. The scrip surged to a high of Rs 107.90 in the intra-day.

Out of the seven Tata Group companies that would get merged with Tata Steel, four are listed. All these four companies were trading with heavy loss.

Tata Steel Long Products Limited slumped 8.73 per cent to Rs 683.50. The scrip hit a low of Rs 679.65 in the intra-day.

MahindraMahindra Financial Services Limited crashed by more than 14 per cent on Friday a day after the Reserve Bank of India (RBI) barred it from using third-party recovery agents.

On the BSE, the share of MahindraMahindra Financial Services Limited was trading 11.42 per cent down at Rs 198.20. The scrip crashed to a low of Rs 192.05 in the intra-day against its previous day's close at Rs 223.75.

The Reserve Bank of India on Thursday announced that it has directed MahindraMahindra Financial Services Ltd (MMFSL) to "immediately cease carrying out any recovery or repossession activity through outsourcing arrangements, till further orders."However, the said NBFC may continue to carry out recovery or repossession activities, through its own employees, the RBI said. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of North Korea Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to North Korea Times.

More InformationInternational

SectionDeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

UN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

UN climate agency gets 10 percent boost amid global budget cuts

BONN, Germany: Despite widespread belt-tightening across the United Nations, nearly 200 countries agreed this week to increase the...

Mexican President orders review of SpaceX environmental impact

MEXICO CITY, Mexico: Mexican President Claudia Sheinbaum said this week that her government is investigating possible environmental...

Business

SectionCanadian tax on US tech giants dropped after Trump fury

WASHINGTON, D.C.: On Friday, President Donald Trump announced that he was halting trade discussions with Canada due to its decision...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

DIY weight-loss drug trend surges amid high prices, low access

SAN FRANCISCO, California: Across the U.S., a growing number of people are taking obesity treatment into their own hands — literally....

Apple allows outside payment links under EU pressure

SAN FRANCISCO, California: Under pressure from European regulators, Apple has revamped its App Store policies in the EU, introducing...

Euro, pound surge as U.S. rate cut odds grow after Powell hint

NEW YORK CITY, New York: The U.S. dollar tumbled this week, hitting its lowest levels since 2021 against the euro, British pound, and...

Sam’s Club fulfillment center to shut in Texas, jobs impacted

NEW YORK CITY, New York: Walmart is set to close a major Sam's Club fulfillment center in Fort Worth, Texas, as part of a shift in...